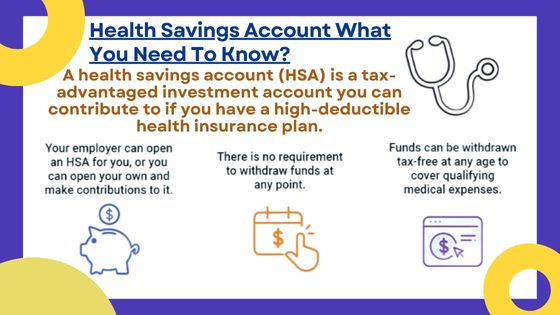

A health savings account reddit (HSA) is a tax-advantaged savings account that individuals can use to pay for medical expenses. It offers a triple tax advantage, allowing for pre-tax contributions, tax-free growth, and tax-free withdrawals when used for qualified medical expenses.

HSAs are an effective way to save on healthcare costs and can be used in conjunction with a high-deductible health insurance plan. They offer flexibility, portability, and the ability to accumulate funds over time. Health savings account reddit are a popular option for individuals looking to take control of their healthcare expenses and save for future medical needs.

Understanding The Benefits And Features

Health savings accounts (HSAs) are a popular topic of discussion on reddit, and for good reason. Understanding the benefits and features of this can help you make smart financial decisions and take control of your healthcare expenses. In this blog post, we’ll delve into the triple tax advantages of hsas, eligibility criteria for opening an hsa, contribution limits and tax-deductible contributions, and how hsas can be used to save for future healthcare expenses.

So, let’s dive in and explore the world of hsas!

Triple Tax Advantages Of Hsas

- Tax-free contributions: When you contribute to your hsa, the money is deducted from your taxable income, which means you can potentially lower your tax liability.

- Tax-deferred growth: The funds in your hsa can grow tax-free, allowing you to accumulate savings over time without worrying about paying taxes on your investment gains.

- Tax-free withdrawals: As long as you use the funds in your hsa for qualified medical expenses, your withdrawals will be tax-free. This means you can save money on taxes while paying for your healthcare needs.

Eligibility Criteria For Opening An HSA

- High-deductible health plan: To be eligible for an hsa, you must have a high-deductible health plan (HDHP). This means that your health insurance plan must have a minimum deductible that meets the requirements set by the irs.

- No other healthcare coverage: You cannot have any other healthcare coverage that is not an hdhp. This includes Medicare, Medicaid, and other comprehensive health insurance plans.

- Not claimed as a dependent: If someone else can claim you as a dependent on their tax return, you are not eligible to open an hsa.

Contribution Limits And Tax-Deductible Contributions

- Contribution limits: In 2021, the maximum contribution limit for an individual with self-only coverage is $3,600, while for those with family coverage, it is $7,200. It’s important to note that these limits may change each year, so make sure to stay updated with the latest information.

- Tax-deductible contributions: Contributions made to your hsa are tax-deductible, which means you can lower your taxable income and potentially pay less in taxes. This can be a significant benefit for those looking to save on their tax bill.

How HSAS Can Be Used To Save For Future Healthcare Expenses

- Flexible savings: Hsas are a great way to save for future healthcare expenses because the funds can be used for a wide range of medical costs. From doctor visits to prescription medications and even dental and vision expenses, you can use your hsa to cover a variety of healthcare needs.

- Long-term investment: If you don’t need to use all the funds in your hsa right away, you can let them grow over time. Many people see this as a long-term investment vehicle for retirement healthcare expenses. This can be especially beneficial as healthcare costs tend to rise over time.

- Portability: Hsas are portable, meaning that they are not tied to a specific employer. This gives you the freedom to take your hsa with you if you change jobs or retire. Your hsa funds will continue to grow and be available for your healthcare needs.

Hsas offer triple tax advantages, have specific eligibility criteria, allow for tax-deductible contributions, and can be used to save for future healthcare expenses. Understanding these benefits and features can empower you to make informed decisions about your healthcare and finances.

Researching And Comparing Options

Health savings account (HSA) providers offer various options to consider when it comes to managing your healthcare expenses. Researching and comparing these options is essential to ensure that you choose the right hsa provider that meets your needs. This section will outline key factors to consider, including comparing fees, investment options, and customer support.

It will also highlight the importance of reading user reviews and feedback on reddit and evaluating the reputation and financial stability of the providers.

Key Factors To Consider When Selecting An HSA Provider

Fees:

- Annual maintenance fees: Consider the fees charged by the providers for managing your account. Compare these fees across different providers to find a cost-effective option.

- Transaction fees: Some hsa providers may charge fees for certain transactions, such as atm withdrawals or check requests. Assess these fees to determine their impact on your overall account management costs.

Investment options:

- Investment opportunities: Check if the hsa provider offers investment options such as mutual funds, stocks, and bonds. Having investment options allows you to grow your hsa funds potentially.

- Minimum investment requirements: Find out the minimum investment amount required by the provider. Consider your investment goals and financial situation to ensure they align with your needs.

Customer support:

- Availability and responsiveness: Assess the availability and responsiveness of customer support offered by the providers. Look for providers that offer multiple channels of communication, such as phone, email, or live chat.

- Knowledge and expertise: Consider the knowledge and expertise of customer support representatives in handling hsa-related queries. Skilled and knowledgeable support can provide valuable assistance when needed.

Reading User Reviews And Feedback On Reddit

User reviews and feedback on reddit can be an excellent resource for evaluating hsa providers. Here’s why:

- Real user experiences: Health savings account reddit allows users to share their firsthand experiences with hsa providers. Reading these reviews can give you an unbiased understanding of the pros and cons of different providers.

- Insights into customer service: User reviews often highlight the quality of customer service offered by hsa providers. Pay attention to feedback regarding responsiveness, knowledge, and effectiveness of customer support representatives.

- Comparison and recommendations: Health savings account reddit discussions can help you compare different hsa providers based on users’ experiences. Look for recommendations from users who share similar goals or financial situations as you.

Evaluating The Reputation And Financial Stability Of HSA Providers

In addition to user reviews, it’s essential to evaluate the reputation and financial stability of the providers before making a decision. Consider the following aspects:

Reputation:

- Research the reputation of the hsa provider within the industry. Look for any accolades, awards, or recognition they have received.

- Consider the provider’s tenure in the market and its overall reputation among customers, healthcare professionals, and financial experts.

Financial stability:

- Assess the financial stability of the hsa provider by reviewing their financial statements and ratings from independent rating agencies.

- Look for providers with a strong financial standing, as this ensures they will be able to handle and support your hsa funds effectively.

You may find an HSA provider that suits your healthcare needs and maximizes savings by carefully studying and comparing costs, investment alternatives, customer assistance, and user ratings and feedback.

Strategies For Saving And Investing

A health savings account reddit (HSA) is a popular tool for individuals to save and invest money for their healthcare expenses. If you have an hsa or are considering opening one, it’s important to have strategies in place to maximize its benefits.

In this section, we will discuss various strategies for saving and investing your Hsa funds.

Setting Realistic Savings Goals And Budgeting For Healthcare Expenses

- Determine your expected healthcare expenses for the year, including deductibles, co-pays, and prescriptions.

- Consider your current health condition and any future medical needs when setting savings goals.

- Allocate a portion of your income towards your hsa regularly to ensure a steady accumulation of funds.

- Review your healthcare expenses periodically to adjust your savings goals and budget accordingly.

- Use budgeting tools or apps to track your healthcare expenses and stay on top of your savings goals.

Strategies For Maximizing Contributions And Taking Advantage Of Employer Contributions

- Contribute the maximum allowable amount to your hsa each year to take full advantage of the tax benefits.

- Consider increasing contributions if you anticipate higher healthcare expenses in the future.

- Take advantage of employer contributions, if available. These are essentially free money that can boost your hsa funds significantly.

- Opt for a high-deductible health insurance plan to qualify for an hsa and receive employer contributions.

- Automate your contributions to ensure consistency and avoid missing out on the tax benefits.

Utilizing Investment Options To Grow Your HSA Funds

- Research and understand the investment options available for your hsa funds.

- Look for low-cost investment options, such as index funds, to maximize your returns.

- Diversify your investments to reduce risk and increase potential gains.

- Review and rebalance your investment portfolio periodically to align with your financial goals.

- Consult with a financial advisor if you’re unsure about investment decisions or need guidance.

Tips For Tracking And Organizing Healthcare Expenses For Future Reimbursement

- Keep all receipts and documentation for healthcare expenses, including doctor visits, prescriptions, and medical procedures.

- Organize your expenses by category and date to make it easier for reimbursement requests.

- Consider using digital tools or apps, specifically designed for tracking healthcare expenses, to simplify the process.

- Keep a record of any reimbursements received from your hsa to ensure accurate accounting.

- Familiarize yourself with the reimbursement rules of your hsa provider to avoid any delays or complications.

By implementing these strategies, you can effectively save and invest your hsa funds to meet your healthcare needs and maximize your financial benefits. Remember to regularly review your goals, contributions, and investments to ensure you are on track and making the most of your hsa.

Navigating The IRS Rules

The Tax Implications Of HSA Contributions And Withdrawals

- Contributions made to your health savings account reddit are tax-deductible, meaning you can lower your taxable income by the amount contributed. This can ultimately reduce the amount of income tax you owe.

- Any withdrawals used for qualified medical expenses are tax-free. This allows you to save money on taxes while utilizing your hsa funds to cover healthcare costs.

- It’s important to note that if you withdraw funds for non-qualified expenses before the age of 65, you’ll be subject to both income tax and a 20% penalty. Avoid using hsa funds for non-medical purposes to prevent unnecessary tax burdens.

Understanding The Rules For Eligible Expenses And Documentation Requirements

- Eligible expenses include a wide range of medical, dental, and vision-related costs. These can include doctor visits, prescription medications, hospital fees, and even some over-the-counter items.

- Proper documentation is crucial when using hsa funds. Keep receipts and invoices for all qualified expenses, as the IRS may request this documentation to verify your claims. It’s recommended to maintain a detailed record of expenses throughout the year to ensure accurate reporting.

How To Report HSA Activity On Your Tax Return

- When filing your tax return, you’ll need to report your hsa activity using form 8889. This form allows you to detail your contributions, withdrawals, and any adjustments necessary.

- Ensure that you accurately report your hsa contributions to maximize your potential tax benefits. Refer to your hsa provider’s statements or consult a tax professional if you’re unsure about the exact figures.

- Remember to keep a copy of your completed form 8889 for your records, as it may be required in case of an audit.

Common Mistakes To Avoid To Prevent Tax Penalties And Audits

Incorrectly reporting hsa contributions or withdrawals can lead to tax penalties and potentially trigger an audit. Avoid these common mistakes to ensure compliance with IRS rules

- Failing to report hsa contributions accurately or at all.

- Using the funds for non-qualified expenses before the age of 65.

- Engaging in prohibited transactions, such as borrowing money from your hsa or using it as collateral.

- Overcontributing to your hsa. Be aware of the annual contribution limits set by the IRS and avoid exceeding them.

Remember, understanding the irs rules regarding your health savings account reddit is vital to navigating the system effectively. By adhering to these rules, you can make the most of your hsa benefits while avoiding potential tax penalties and audits.

Leveraging HSA Investments And Long-Term Planning

Health savings account (HSA) investments offer a unique opportunity for individuals to not only save on taxes but also grow their funds for the long term. By leveraging the investments and engaging in strategic long-term planning, account holders can maximize the potential of their healthcare savings.

This section explores the various aspects of investing hsa funds, balancing risk and diversification, exploring alternative investment options, and considering long-term planning beyond healthcare expenses.

Investing HSA Funds For Long-Term Growth And Retirement Planning

- Diversify your investment portfolio to mitigate risk and increase potential returns.

- Consider allocating a portion of your hsa funds to growth-oriented investments.

- Research and assess investment options that align with your risk tolerance and long-term goals.

- Explore low-cost index funds or exchange-traded funds (ETFs) that offer broad market exposure.

- Regularly review and rebalance your investment portfolio to maintain optimal asset allocation.

- Consult with a certified financial planner or investment professional for personalized advice.

Balancing Risk And Diversification In HSA Investment Portfolios

- Understand your risk tolerance and investment timeline before making investment decisions.

- Consider a mix of asset classes, such as stocks, bonds, and cash equivalents, to diversify your portfolio.

- Evaluate the potential return and volatility of different investment options.

- Reassess your risk tolerance periodically and adjust your investment strategy accordingly.

- Stay informed about market trends and economic indicators to make well-informed investment decisions.

- Keep in mind that the funds should be primarily utilized for healthcare expenses in the short term.

Exploring Alternative Investment Options And Self-Directed HSAS

- Some hsa providers offer self-directed accounts, allowing individuals to invest in a broader range of assets.

- Alternative investment options may include real estate, precious metals, or private equity.

- Research and understand the risks associated with alternative investments before making any decisions.

- Consider the potential tax advantages and drawbacks of self-directed hsa investments.

- Work closely with a qualified custodian or financial advisor who is well-versed in self-directed hsas.

- Ensure compliance with irs regulations and guidelines when investing through self-directed hsa accounts.

Long-Term Planning Considerations Beyond Healthcare Expenses

- Evaluate your overall financial goals and aspirations to determine the role of hsa funds in your long-term plan.

- Recognize that the funds can be used for non-healthcare expenses after age 65 without penalty.

- Incorporate hsa funds into your retirement savings strategy to maximize tax advantages.

- Prioritize building an emergency fund before considering long-term investments using hsa funds.

- Review your hsa investment strategy in conjunction with other retirement accounts, such as 401(k) plans or iras.

- Seek the guidance of a financial advisor or retirement planner to ensure a comprehensive approach to long-term planning.

Using HSA investments and effective long-term planning, people can maximize the benefits of their health savings account Reddit. It’s essential to carefully assess individual goals, risk tolerance, and investment options to make informed decisions for financial well-being and security in retirement.

Learning From HSA User’s Experience

Hearing success stories from reddit users who have maximized their hsa benefits:

Many reddit users have shared their experiences of successfully maximizing their hsa benefits. Here are some key takeaways:

- Invest early: By starting to contribute to their hsa as soon as possible, users have been able to build substantial funds over time.

- Taking advantage of employer contributions: Some users have leveraged employer matching contributions to boost their hsa savings.

- Strategic contributions: By contributing the maximum allowed amount each year and taking advantage of catch-up contributions for those aged 55 and above, reddit users have been able to make the most of their hsa benefits.

- Utilizing tax advantages: Hsa contributions are tax-deductible, and users have found that maximizing contributions can lead to significant tax savings.

Lessons learned From Mistakes Made By Others

In addition to success stories, reddit is also a place where users share their mistakes and lessons learned. Here are some valuable insights:

- Checking for eligible expenses: Reddit users advise others to familiarize themselves with the irs guidelines on eligible hsa expenses to avoid potential penalties.

- Understanding plan limitations: Users have emphasized the importance of carefully reviewing the terms and conditions of their hsa plans, particularly regarding rollovers, fees, and investment options.

- Keeping track of receipts and documentation: Redditors have highlighted the need to maintain thorough records of hsa-related expenses to ensure smooth reimbursement and tax documentation.

Applying Insider Tips And Advice To Your HSA Strategy

Armed with the knowledge gained from success stories, mistakes made by others, and q&a sessions, you can refine your hsa strategy:

- Incorporating successful tactics: By implementing strategies and techniques that have proven successful for reddit users, you can optimize your hsa benefits.

- Avoiding common pitfalls: Learning from others’ mistakes can help you avoid potential pitfalls and make more informed decisions regarding your hsa.

- Tailoring advice to your situation: Applying insider tips and advice gathered from reddit contributors to your unique circumstances can help you create a personalized hsa strategy that maximizes your benefits.

Remember, leveraging the experiences and expertise shared on reddit can provide invaluable guidance as you navigate the world of health savings account reddit. So, dive into the wealth of information available on the platform and optimize your hsa strategy today.

HSA Pros And Cons

A Health Investment Funds Account is a tax-advantaged account arranged to help individuals save for restorative costs. It’s regularly utilized close high-deductible well-being plans (HDHPs). Here’s a diagram of its aces and cons:

Pros Of An HSA

- Tax Benefits: Commitments to an HSA are tax-deductible, meaning they lower your assessable salary. In addition, a benefit on the account is tax-free, and withdrawals for qualified, helpful costs are tax-free.

- Flexibility: Stores in an HSA can be utilized for different restorative costs, including specialist visits, medicines, and over-the-counter items. They can also pay for future healthcare costs as the reserves roll over yearly.

- Portability: The account remains with you regardless of work changes, retirement, or changes in well-being protections. This makes it a long-term investment vehicle for healthcare costs.

- Investment Openings: Numerous HSAs offer the alternative to contributing the stores in stocks, bonds, or ordinary stores, permitting your reserve funds to develop over time.

Cons Of An HSA

- Penalties for Non-Qualified Costs: If you withdraw reserves for non-qualified costs after age 65, you’ll face a 20% penalty and additional charges on the withdrawal amount.

- Complexity: Overseeing an HSA can be more complex than managing other investment funds accounts, particularly when tracking receipts and guaranteeing that withdrawals are for qualified expenses.

- Contribution Limits: There are yearly limits on how much you can contribute to an HSA, which might not be adequate to cover all your restorative costs, particularly in persistent ailment or startling major well-being issues.

- Investment Chance: Contributing to your HSA reserves can offer growth, but it also carries dangers. The esteem of your ventures can fluctuate, and you might lose cash, particularly if the stores are required in the short term.

HSAs can be a capable device for those who can manage a high-deductible plan and are looking to save on charges while planning for future therapeutic costs. They require cautious administration and may be appropriate for a few.

Frequently Asked Questions For Health Savings Account Reddit

What Is A Health Savings Account (HSA)?

A health savings account (hsa) is a tax-advantaged savings account that allows individuals to save and pay for qualified medical expenses. It offers triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals are tax-free when used for eligible medical expenses.

How Does A Health Savings Account Work?

A health savings account (hsa) works by allowing individuals to contribute pre-tax money into the account, which can then be used to pay for eligible medical expenses. Contributions are tax-deductible, and any unused funds can roll over each year. The account is linked to a high-deductible health insurance plan.

What Are The Benefits Of Having A Health Savings Account?

Having a health savings account reddit (hsa) offers several benefits. Firstly, contributions are tax-deductible, reducing your taxable income. Secondly, the funds in the account can grow tax-free, allowing for potential long-term savings. Lastly, the flexibility to use the funds for qualified medical expenses makes it a valuable tool for healthcare planning.

Can Anyone Open A Health Savings Account?

Not everyone can open a health savings account (hsa). To be eligible, you must have a high-deductible health insurance plan. Additionally, you cannot be enrolled in any other non-hsa compatible health coverage, such as Medicare or another health plan.

What Are Qualified Medical Expenses For A Health Savings Account?

Qualified medical expenses for a health savings account (hsa) include a wide range of healthcare services, such as doctor’s visits, prescription medications, dental and vision care, and certain medical equipment. However, it’s essential to review the irs guidelines to ensure expenses are eligible before using the funds.

Conclusion

A health savings account reddit (hsa) offers numerous benefits for reddit users seeking to save on healthcare costs and take control of their medical expenses. With its tax advantages, flexibility, and potential to grow funds over time, an hsa can be a powerful tool in managing healthcare expenses.

By using an hsa, users can save money on premiums, enjoy tax-free contributions and withdrawals, and even invest their funds for potential growth. Additionally, hsa contributions are not subject to income tax, making it an appealing option for those looking to save money on their taxes while still having funds set aside for medical expenses.

Whether you are looking to save for future healthcare needs or seeking a way to reduce your tax burden, a health savings account reddit can be a smart financial strategy. Explore the possibilities and start taking control of your healthcare expenses today.

I am an SEO expert, Digital Marketing-specialized writer, and blogger based in the USA & UK. I have four years of experience in SEO, Digital Marketing, Social Media, and Technology. So, I work on solving these issues and give various tips on these issues