Nonprofit health insurance is a type of health coverage provided by charitable organizations that aim to support and improve the well-being of individuals and communities. Introducing the concept of nonprofit health insurance, it is important to recognize how these charitable organizations play a crucial role in supporting the well-being of individuals and communities.

Not only do they provide health coverage, but they also strive to make a meaningful impact by promoting access to quality healthcare services. Nonprofit health insurance involves charitable organizations offering coverage options that cater to the specific needs of their members.

By operating with a philanthropic mindset, these organizations aim to improve the overall health and welfare of the population they serve. We will explore the benefits, features, and factors to consider when opting for nonprofit health insurance.

What Is Nonprofit Health Insurance And How Does It Work?

Nonprofit health insurance is a form of health coverage offered by organizations focused on providing affordable healthcare services rather than generating profits. It operates through the collection of premiums and the pooling of funds to cover the medical expenses of its members.

Definition Of Nonprofit Health Insurance

- Nonprofit health insurance refers to a type of insurance coverage provided by organizations that do not operate for the purpose of earning profits. Instead, these organizations are dedicated to serving their members and communities, ensuring access to affordable healthcare options.

- These nonprofit insurance providers exist in various forms, such as health maintenance organizations (hmos) or nonprofit health insurers. They focus on promoting collective well-being and prioritize the needs of their members.

Explanation Of The Functioning Of Nonprofit Health Insurance

Nonprofit health insurance operates differently from for-profit insurance companies. Here’s how it works:

- Membership: Nonprofit health insurance requires individuals to become members of the organization by paying monthly premiums or contributions. Becoming a member grants certain benefits and access to a network of healthcare providers.

- Focus on preventive care: Nonprofit health insurance emphasizes preventive care, encouraging members to maintain their health through regular check-ups, screenings, and vaccinations. By prioritizing preventive measures, these organizations aim to reduce the long-term healthcare expenses of their members.

- Provider network: Nonprofit health insurance entities often have their own network of healthcare providers, including hospitals, clinics, and specialists. They negotiate contracts with these providers to ensure cost-effective and quality care for their members.

- Cost containment: These organizations strive to keep healthcare costs under control by implementing cost containment strategies. This may involve negotiating favorable rates with healthcare providers, managing healthcare utilization, and emphasizing generic drugs instead of expensive brand-name medications.

- Community support: Nonprofit health insurers invest in their communities by supporting initiatives that enhance public health, promote health education, and provide assistance to those in need. This commitment to community well-being sets them apart from for-profit insurance companies.

- Member engagement: Nonprofit health insurance emphasizes member engagement, offering various programs for health and wellness education. They often provide resources like wellness screenings, health coaching, and health management tools to empower members to take control of their well-being.

By operating with the best interests of their members and communities in mind, nonprofit health insurance plans strive to provide affordable, comprehensive, and member-focused coverage.

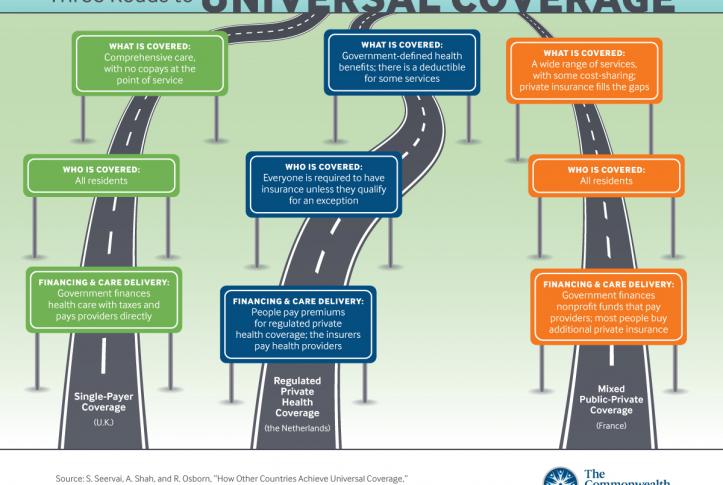

Credit: www.commonwealthfund.org

Benefits Of Choosing Nonprofit Health Insurance

Nonprofit health insurance offers numerous benefits, including affordable premiums, comprehensive coverage options, and a focus on community well-being. Emphasizing affordability and community support, nonprofit health insurance provides a valuable alternative for individuals and families seeking reliable healthcare coverage.

Affordable Coverage Options

Nonprofit health insurance offers a range of benefits that make it an appealing option for individuals and families seeking affordable coverage. Here are some key advantages:

- Lower premiums: Nonprofit health insurance plans often have lower monthly premiums compared to for-profit insurance providers. This can significantly reduce the financial burden of health coverage, especially for individuals with limited budgets.

- Cost-sharing options: Many nonprofit insurers offer cost-sharing options, such as reduced deductibles and copayments. These cost-sharing arrangements help to make healthcare more accessible and affordable for policyholders.

- Sliding fee scales: Nonprofit health insurance providers frequently implement sliding fee scales, which means that premium amounts are based on individuals’ incomes. This approach ensures that coverage remains affordable for people across various income brackets.

- Government subsidies: Nonprofit insurers often qualify for government subsidies, further lowering premiums and out-of-pocket costs for policyholders. This financial assistance helps individuals and families access comprehensive healthcare without breaking the bank.

Comprehensive Health Plans

Choosing nonprofit health insurance means gaining access to comprehensive health plans that cover a wide range of medical services. Here’s what you can expect from nonprofit health plans:

- Preventive care: Nonprofit insurers prioritize preventive care, offering coverage for essential screenings, vaccinations, and wellness programs. These proactive measures focus on early detection and prevention, promoting overall health and reducing the risk of serious illnesses.

- Hospitalization and surgeries: Nonprofit health plans typically cover hospital stays, surgeries, and other medical procedures. This ensures that policyholders are protected financially in the event of major medical interventions or emergencies.

- Prescription medications: Nonprofit health insurance often includes prescription drug coverage, which helps offset the cost of essential medications. This provision ensures that individuals with chronic conditions receive the required treatments without incurring high out-of-pocket expenses.

- Mental health and substance abuse services: Nonprofit health plans prioritize mental health and substance abuse support, providing coverage for therapy sessions, counseling, and substance abuse treatment programs. This holistic approach acknowledges the importance of mental well-being in overall health.

- Maternity and newborn care: Expecting parents can benefit from nonprofit health insurance plans that offer comprehensive coverage for prenatal care, labor and delivery, and postnatal services. These plans prioritize the health of both the mother and the newborn.

Access To A Network Of Healthcare Providers

Nonprofit health insurance provides policyholders with access to a network of healthcare providers, ensuring timely and comprehensive medical services. Here’s why having access to a network of healthcare providers is advantageous:

- Wide choice of doctors and specialists: Nonprofit health insurance plans often have agreements with a broad network of doctors, specialists, and hospitals. This means policyholders can choose from a wider pool of healthcare professionals, helping them find the right providers for their specific needs.

- Coordinated care: Nonprofit insurers prioritize coordinated care, making it easier for policyholders to manage their healthcare journey. Through streamlined communication and information sharing, providers within the network work together to ensure seamless continuity of care.

- Reduced out-of-pocket costs: Utilizing in-network healthcare providers can lead to lower out-of-pocket costs for policyholders. Nonprofit health insurance plans often offer discounted rates and negotiated prices for services rendered by network providers, reducing financial burden.

- Quality assurance: Nonprofit health insurers often have strict quality assurance measures in place for the providers within their networks. This ensures that policyholders have access to high-quality healthcare professionals who meet specific standards of care.

Choosing nonprofit health insurance brings numerous benefits, including affordable coverage options, comprehensive health plans, and access to a network of healthcare providers. These advantages make nonprofit health insurance an attractive choice for individuals and families seeking quality and affordable healthcare.

How Nonprofit Health Insurance Differs From For-Profit Alternatives

Nonprofit health insurance differs from for-profit alternatives due to its focus on serving the community rather than generating profits. These plans prioritize affordable coverage, preventive care, and reinvesting any surplus back into improving healthcare services.

Nonprofit Health Insurance

When it comes to healthcare coverage, nonprofit health insurance stands apart from for-profit alternatives in various ways. In this section, we will delve into the specific differences, including a comparison of cost and coverage, as well as an analysis of the philosophy behind nonprofit health insurance.

Comparison Of Cost And Coverage

- Lower premiums: Nonprofit health insurance plans are generally known for offering lower premium rates, making them more accessible to individuals and families seeking affordable coverage.

- Cost savings: With nonprofit health insurers, there is often a greater emphasis on minimizing administrative costs, resulting in more cost-effective coverage options.

- Focus on community: Nonprofit insurers prioritize community health needs, aiming to deliver comprehensive coverage to underserved populations by keeping costs reasonable.

Analysis Of The Philosophy Behind Nonprofit Health Insurance

Nonprofit health insurance is driven by a different philosophy compared to for-profit alternatives, focusing on the well-being of its members rather than financial gains.

- Member-centric approach: Nonprofit health insurers prioritize the health and well-being of their members, placing their needs at the forefront. This includes ensuring that coverage is accessible and affordable.

- Community impact: Nonprofit health insurers often engage in initiatives that benefit the broader community, such as wellness programs, health education, and outreach efforts.

- Mission-driven: These insurers operate with a mission to provide quality healthcare coverage to as many individuals as possible, ensuring that everyone has access to the care they need.

Nonprofit health insurance differs from for-profit alternatives in terms of cost, coverage, and philosophy. With lower premiums, cost savings, and a member-centric approach, nonprofit health insurance prioritizes the well-being of its members and the community as a whole.

Researching Nonprofit Health Insurance Providers

Researching nonprofit health insurance providers is essential for individuals and organizations seeking affordable and ethical coverage options. By exploring these providers, you can access comprehensive healthcare benefits that align with your values, supporting the wellbeing of both yourself and your community.

Overview Of Reputable Nonprofit Health Insurance Providers

Nonprofit health insurance providers are organizations that operate with the primary goal of improving public health. These providers are known for their commitment to offering affordable and comprehensive coverage to individuals and families who may not have access to employer-sponsored plans.

When researching nonprofit health insurance providers, it is essential to consider factors such as their reputation, coverage options, network, and financial stability. Here are some key points to keep in mind:

Reputation:

- Look for nonprofit health insurance providers that have a long-standing reputation for providing quality coverage and excellent customer service.

- Research customer reviews and ratings to gain insights into the experiences of current and past beneficiaries.

Coverage options:

- Consider the range of coverage options offered by nonprofit health insurance providers.

- Evaluate whether they offer individual, family, or group plans that suit your specific needs.

- Look for plans that include a comprehensive set of benefits, including preventive care, hospitalization, prescription drugs, and specialized services.

Network:

- Assess the provider’s network of healthcare providers, including doctors, specialists, hospitals, and pharmacies.

- Ensure that the network is extensive, enabling you to access quality healthcare professionals when needed.

- Confirm that the provider has partnerships with healthcare facilities and professionals in your preferred geographical area.

Financial stability:

- Verify the financial stability of the nonprofit health insurance providers under consideration.

- Look for indicators such as their financial ratings and stability assessments from reputable rating agencies.

- Evaluate their long-term sustainability to ensure that they can continue to provide coverage in the future.

Researching nonprofit health insurance providers will help you identify reputable options that align with your healthcare needs and budget. By considering aspects such as reputation, coverage options, network, and financial stability, you can make an informed decision when selecting a nonprofit health insurance provider.

Evaluating Coverage Options

Evaluate your nonprofit health insurance coverage options to ensure you find the best fit for your organization’s needs. Compare plans, costs, and benefits to make an informed decision.

Understanding Different Types Of Coverage Offered By Nonprofit Health Insurance Plans

Nonprofit health insurance plans offer a range of coverage options to meet the diverse needs of individuals and families. These plans are designed to prioritize the well-being of their members and often provide comprehensive benefits. Here’s a breakdown of the different types of coverage offered by nonprofit health insurance plans:

- Medical coverage: This includes coverage for doctor visits, hospital stays, surgeries, and other medical services. It ensures that you have access to essential healthcare and can receive necessary treatments.

- Prescription drug coverage: Nonprofit health insurance plans typically offer coverage for prescription medications, reducing the financial burden of expensive drugs and making them more affordable for members.

- Mental health coverage: Many nonprofit health insurance plans recognize the importance of mental health and provide coverage for services like therapy, counseling, and psychiatric care. This coverage ensures that individuals can access the support they need.

- Preventive care: Nonprofit health insurance plans often prioritize preventive care services, such as vaccinations, screenings, and wellness check-ups. These services focus on early detection and prevention of diseases, promoting overall wellbeing.

- Maternity and pediatric coverage: For individuals or families planning to start or expand their family, nonprofit health insurance plans often offer comprehensive maternity and pediatric coverage. This includes prenatal care, labor and delivery, and child healthcare services.

Comparing Coverage Benefits And Limitations

When evaluating coverage options offered by nonprofit health insurance plans, it’s important to consider both the benefits and limitations. Here are some key factors to consider:

- Network coverage: Nonprofit health insurance plans may have a network of healthcare providers, including doctors, hospitals, and specialists. Assess if your preferred healthcare providers are in-network to ensure you can receive care from them at a lower cost.

- Out-of-pocket costs: Understand the out-of-pocket costs associated with the plan, such as deductibles, copayments, and coinsurance. Compare these costs with the level of coverage provided to determine the overall affordability of the plan.

- Coverage limitations: Take note of any coverage limitations, such as restrictions on certain treatments, therapies, or medications. Familiarize yourself with these limitations to determine if they align with your healthcare needs.

- Additional benefits: Some nonprofit health insurance plans offer additional benefits like wellness programs, telehealth services, or discounts on complementary treatments. Assess these additional benefits to identify if they align with your personal preferences and can enhance your overall healthcare experience.

- Customer satisfaction: Consider researching customer reviews or ratings of nonprofit health insurance plans to gauge their overall satisfaction. This can provide insights into the quality of services and member experiences.

Remember, when evaluating coverage options, it’s important to consider your unique healthcare needs, preferred healthcare providers, and budget. Take the time to compare different plans and their benefits and limitations to make an informed choice that suits your requirements.

Determining Affordability

Determining the affordability of nonprofit health insurance is essential for individuals and families. Evaluating costs, coverage, and benefits helps ensure access to affordable healthcare options.

Health insurance is a crucial aspect of our lives, ensuring we have access to quality healthcare when we need it most. For nonprofit organizations, finding affordable health insurance options can be a challenge. In this section, we will dive into the topic of determining affordability in nonprofit health insurance, including calculating premiums and deductibles, as well as exploring financial assistance options.

Calculating Premiums And Deductibles

- Premiums: These are the monthly payments you make to your health insurance provider. Calculating premiums involves considering various factors such as the coverage level, type of plan, and the number of employees covered. Premiums can vary based on factors such as age, location, and the benefits provided.

- Deductibles: Deductibles refer to the amount you must pay out of pocket for covered services before your insurance coverage kicks in. It’s important to understand how deductibles work, as higher deductibles often correspond with lower monthly premiums. Consider these points when calculating deductibles:

- Determine the deductible amount: Some plans have a single deductible, while others may require individual or family deductibles. It’s essential to understand the specific terms of your plan.

- Understand the difference between individual and family deductibles: For plans with family coverage, the family deductible is typically higher than the individual deductible. However, once the family deductible is met, individual family members’ expenses may be covered without reaching their individual deductibles.

Exploring Financial Assistance Options

- Medicaid: Medicaid is a joint federal and state program that provides health coverage for individuals and families with limited income. Eligibility criteria vary by state, but medicaid can offer significant financial assistance for nonprofit organizations with lower-income employees.

- Children’s health insurance program (chip): Chip is a state program that provides low-cost health coverage to children from low-income families. This program may be an option for nonprofit organizations that have employees with children who need health insurance.

- Health insurance marketplaces: The health insurance marketplace, also known as the exchange, is an online platform where individuals and small businesses can shop for health insurance plans. It offers subsidies and tax credits based on income levels, making health insurance more affordable.

- Healthcare tax credits: Some nonprofit organizations may qualify for the small business health care tax credit, which can help reduce the cost of providing health insurance to employees. This tax credit is available to organizations with fewer than 25 full-time equivalent employees, paying average wages of less than $50,000 a year.

Navigating the world of nonprofit health insurance can be overwhelming, but by understanding how to determine affordability and exploring financial assistance options, organizations can find viable solutions to ensure their employees have access to quality healthcare coverage.

Utilizing Preventive Care Services

Utilize preventive care services to optimize your nonprofit health insurance coverage and ensure early detection of potential health issues. Access regular check-ups, screenings, and vaccinations to maintain your well-being and reduce medical costs in the long run.

Importance Of Routine Check-Ups And Screenings

Regular check-ups and screenings play a vital role in maintaining good health and preventing potential health issues. Here’s why they are important:

- Early detection: Routine check-ups allow healthcare professionals to identify any health problems early on, increasing the chances of successful treatment and improved outcomes.

- Prevention is key: Regular screenings help detect risk factors, allowing healthcare providers to implement preventive measures. This proactive approach can prevent the development of chronic conditions and minimize the risk of severe illnesses.

- Promoting overall well-being: Routine check-ups provide an opportunity for healthcare providers to assess and address various aspects of an individual’s health. This includes discussing lifestyle habits, providing guidance on healthy behaviors, and suggesting appropriate interventions.

- Managing existing conditions: For individuals with chronic diseases, regular check-ups help monitor the condition’s progress, make necessary adjustments to treatment plans, and prevent any potential complications.

Coverage For Preventive Care Under Nonprofit Health Insurance:

Nonprofit health insurance plans prioritize preventive care services, ensuring that individuals have access to necessary screenings and check-ups. Here’s how nonprofit health insurance covers preventive care:

- Comprehensive coverage: Nonprofit health insurance plans often cover a wide range of preventive services, including immunizations, blood pressure screenings, cholesterol checks, cancer screenings, and more.

- Cost-sharing benefits: Nonprofit health insurance plans may offer preventive care services at little or no cost to the individual. This eliminates financial barriers and encourages individuals to utilize these essential services.

- Access to networks: Nonprofit health insurance plans typically have a network of healthcare providers, ensuring that individuals can find providers who offer the required preventive care services within their coverage.

- Health education and promotion: In addition to coverage, nonprofit health insurance plans often provide education and resources to promote healthy behaviors and encourage individuals to undergo recommended screenings and check-ups.

- Empowering individuals: By prioritizing preventive care, nonprofit health insurance plans empower individuals to take control of their health, leading to better health outcomes and reduced healthcare costs in the long run.

Remember, regular check-ups and screenings are crucial for maintaining good health and preventing potential health issues. Nonprofit health insurance plans prioritize preventive care services, ensuring comprehensive coverage and reducing financial barriers. By utilizing these services, individuals can proactively manage their health and improve their overall well-being.

Managing Chronic Conditions

Discover effective management strategies for chronic conditions through nonprofit health insurance, ensuring access to affordable healthcare and support for individuals with ongoing health challenges. Find comprehensive coverage options tailored to your specific needs, empowering you to live a healthier and more fulfilling life.

Access To Specialists And Ongoing Care

Chronic conditions require ongoing management and access to specialists to ensure the best possible health outcomes. Nonprofit health insurance plans prioritize providing their members with access to specialized care and continuous monitoring. Here are some ways nonprofit health insurance ensures access to specialists and ongoing care:

- Seamless referral process: Nonprofit health insurance plans have established networks of healthcare providers, which include specialists who can effectively manage chronic conditions. This allows for a seamless referral process, ensuring that members can easily access specialists when needed.

- Care coordination: Nonprofit health insurance plans focus on care coordination for individuals with chronic conditions. This means that primary care physicians and specialists work together to develop personalized care plans, monitor progress, and make necessary adjustments to ensure optimal health outcomes.

- Disease management programs: Nonprofit health insurance plans often offer disease management programs for chronic conditions. These programs provide education, coaching, and support to help members better understand and manage their conditions. By empowering individuals with information and resources, nonprofit health insurance enhances their ability to proactively manage their chronic conditions.

- Regular monitoring and follow-ups: To effectively manage chronic conditions, regular monitoring and follow-ups are essential. Nonprofit health insurance plans prioritize regular check-ups, tests, and screenings to monitor the progression of chronic conditions. This proactive approach allows for early intervention and preventative measures, resulting in better long-term outcomes.

- Access to necessary treatments: Nonprofit health insurance plans understand the importance of medication and treatments for chronic conditions. These plans typically cover the necessary prescription medications and treatments, ensuring that members have access to the resources they need to effectively manage their conditions.

Nonprofit health insurance plans go above and beyond to ensure access to specialists and ongoing care for individuals with chronic conditions. By providing a comprehensive network of healthcare providers, disease management programs, and coverage for necessary treatments, these plans prioritize the well-being of their members with chronic conditions.

Navigating The Healthcare System

Navigate the complex healthcare system with ease by accessing nonprofit health insurance options. Protect yourself and your family with comprehensive coverage that prioritizes your well-being. Discover a seamless path to healthcare services without the financial burden.

Understanding Health Insurance Terminology

- Deductible: The amount you must pay out of pocket before your insurance coverage begins.

- Premium: The amount you pay each month for your health insurance plan.

- Copayment: A fixed amount you pay for a covered service, such as a doctor’s visit or prescription medication.

- Network: The group of doctors, hospitals, and other healthcare providers that have agreed to provide services at reduced rates to insurance plan members.

- Out-of-network: Healthcare providers that are not part of your insurance plan’s network. Visiting an out-of-network provider may result in higher costs or limited coverage.

Tips For Navigating Claims, Referrals, And Medical Bills

- Keep track of all medical bills and insurance statements: It’s important to review your bills and insurance statements for accuracy and ensure that you are not being overcharged or billed for services you didn’t receive.

- Understand your coverage: Familiarize yourself with your health insurance plan’s coverage details, including what services are covered, what the copayments and deductibles are, and which providers are in-network.

- Communicate with your healthcare provider: If you have questions about the cost of a particular treatment or whether it will be covered by your insurance, don’t hesitate to ask your healthcare provider for clarification.

- Obtain referrals when necessary: Some health insurance plans require a referral from your primary care physician before seeing a specialist. Make sure to obtain the necessary referrals to ensure coverage for specialist visits.

- Follow up on claims: If you have submitted a claim to your health insurance provider and haven’t received a response within a reasonable time frame, follow up to ensure that it is being processed correctly.

- Negotiate medical bills if needed: If you receive a medical bill that is higher than expected or if you are having trouble paying it, reach out to the healthcare provider’s billing department to discuss possible payment options or negotiate a lower bill.

Navigating the healthcare system can be overwhelming, but understanding health insurance terminology and knowing how to navigate claims, referrals, and medical bills can help make the process smoother. By staying informed, communicating with healthcare providers, and advocating for yourself, you can ensure that you are utilizing your health insurance effectively and receiving the care you need without undue financial burden.

Frequently Asked Questions Of Nonprofit Health Insurance

What Is Nonprofit Health Insurance?

Nonprofit health insurance refers to health insurance plans provided by nonprofit organizations. These plans are designed to offer affordable coverage to individuals and families, with a focus on community service instead of generating profits. Nonprofit health insurance plans often have lower premiums and provide access to a network of healthcare providers.

How Does Nonprofit Health Insurance Work?

Nonprofit health insurance works by pooling together the funds collected from members’ premiums to provide coverage for medical expenses. These plans negotiate rates with healthcare providers to offer discounted services to their members. Nonprofit health insurance plans aim to reinvest any leftover funds back into the community to improve healthcare access and services.

What Are The Benefits Of Nonprofit Health Insurance?

Nonprofit health insurance offers several benefits, including lower premiums, comprehensive coverage options, and a focus on community well-being. By choosing a nonprofit health insurance plan, individuals can support organizations that prioritize serving the community and reinvesting any surplus funds into improving healthcare services and access.

How Can I Qualify For Nonprofit Health Insurance?

Qualifications for nonprofit health insurance plans may vary, but typically these plans are available to individuals and families who meet certain income and residency requirements. Some nonprofit health insurance plans may also be available to specific groups, such as low-income individuals, certain professions, or residents of a specific geographical area.

What Services Are Covered By Nonprofit Health Insurance?

Nonprofit health insurance plans generally offer coverage for a range of services, including preventive care, hospital stays, physician visits, prescription medications, and specialized treatments. However, the specific services covered may vary depending on the plan and the individual’s needs. It’s important to review the plan’s coverage details and limitations before enrolling.

Conclusion

Nonprofit health insurance provides a crucial safety net for individuals and families who may otherwise struggle to access affordable healthcare. By prioritizing the needs of their members over profits, these organizations are able to offer a range of comprehensive coverage options at more affordable prices.

Additionally, nonprofit health insurers often invest in initiatives aimed at improving public health and reducing healthcare disparities. This commitment to social welfare sets them apart from their for-profit counterparts and demonstrates their genuine dedication to making a positive impact on their communities.

Whether you’re in need of individual or group coverage, nonprofit health insurance can provide a viable, ethical solution. So, if you’re searching for healthcare coverage that not only meets your needs but also aligns with your values, consider exploring the options offered by nonprofit insurers.

I am an SEO expert, Digital Marketing-specialized writer, and blogger based in the USA & UK. I have four years of experience in SEO, Digital Marketing, Social Media, and Technology. So, I work on solving these issues and give various tips on these issues